Part 2: China

Key Takeaways:

- Recent weakness in commodity prices and Chinese equity underperformance has puzzled analysts who predicted that the post-Covid reopening would substantially boost its own and global growth

- MacroX’s real-time Nowcast shows the Chinese economy is stalling – helping to make sense of the recent down market moves

- Tracking trading partner economies such as Australia with more reliable data, alongside a more detailed look at a Chinese city-level “diffusion index” tells a similar story

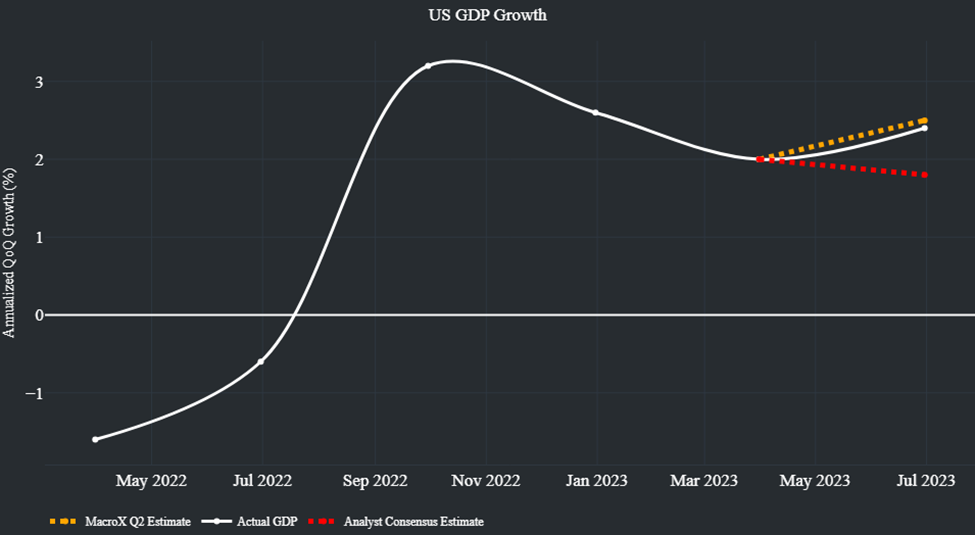

This is the second blog in our series on measuring economic activity across the globe using alternative data and AI. Having established its usefulness in developed countries such as the US, we now look to see if this continues to be the case in emerging markets like China.

Chinese Reopening: Is the Momentum stalling?

China is a crucial driver of the world economy. Given the recession fears prevalent across developed economies, China’s relaxation of its zero-covid policy in December 2022 and subsequent reopening sparked hopes of a fast economic recovery that could propel global growth this year. Anticipation of future Chinese demand caused commodity prices to rally aggressively and Goldman Sachs predicted that the reopening “could raise global GDP by 1% by the end of 2023”. China’s Q1 GDP headline data certainly suggests a strong recovery is underway with output increasing by 4.5% yoy.

However, markets have recently become more skeptical. Observers keen to see increased private consumption powering the recovery were disappointed as Chinese private sector demand remains weak, with growth in public sector infrastructure investment once again playing a key role in the growth number for Q1. This has resulted in commodity price growth stalling, if not reversing, with Shanghai steel rebar futures down 10% from their peak in March even as we enter the Chinese construction season. Furthermore, valuations in the MSCI China Index are contracting with its performance in April disappointing as compared to other global benchmarks – “confounding analysts who say reasons to own the (Chinese) market are finally coming true”.

The problem with Chinese data

Given the importance of China to the global economy, Chinese data is key to investors forming macro views. Unfortunately, trust in official Chinese data is low due to an opaque calculation process and historic scandals where local governments have admitted to falsifying data. Alternative measures of economic activity available to investors include the survey-based PMIs and the Li Keqiang index which uses electricity consumption, rail cargo, and bank lending as proxies for economic growth. However, as our previous blog points out, all these data are delayed! The Le Keqiang index is published more than a month after the fact and the official industrial production data and PMI is only available 2+ weeks post the end of the month.

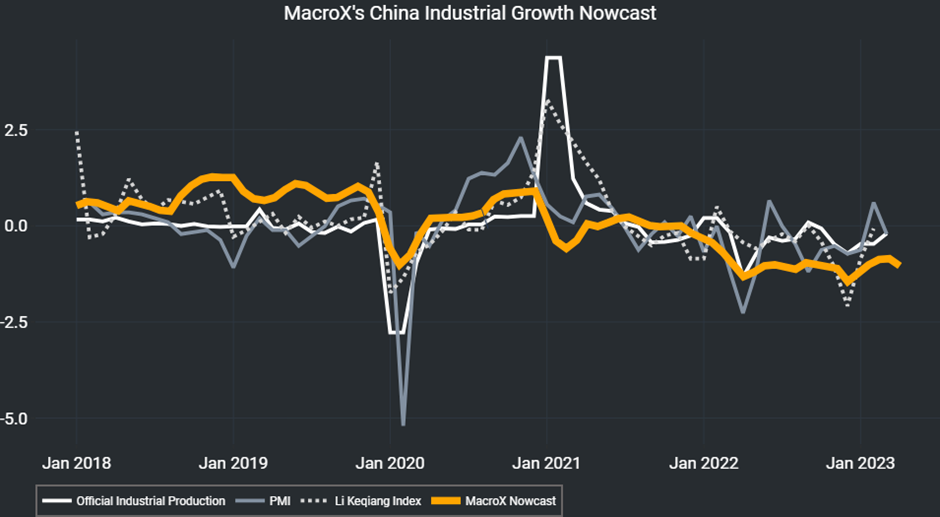

MacroX’s Chinese Industrial Growth Nowcast

Given the above issues with Chinese data, non-traditional measures of economic activity can be a useful option. MacroX’s Nowcast of Chinese Industrial Growth uses a combination of alternative data sources (micro, news, social, sensor, satellite, etc.) to feed into its cutting-edge AI model to generate real-time insights into industrial activity growth. Our Nowcast closely tracks other measures of Chinese activity demonstrating that it is accurate, as shown in the chart below:

Our Nowcast shows that, after a modest upswing in industrial activity growth in Q1 2023, industrial growth has stalled over the last few weeks as activity begins to contract at an increased pace. We see no evidence of an acceleration in Chinese growth helping to explain recent market moves in commodity markets and Chinese equity underperformance.

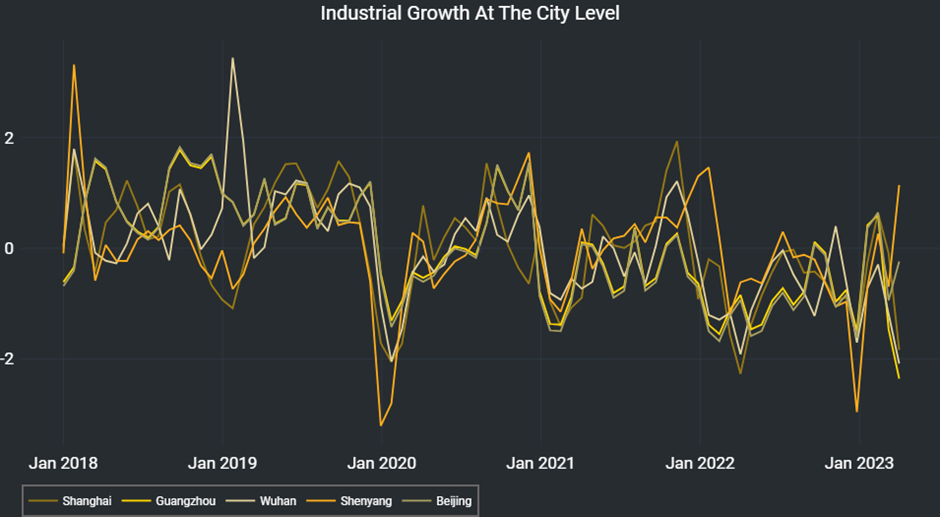

Further evidence of stalling: Insights from major manufacturing hubs and trading partners

One tool that MacroX provides is the ability to look deeper by investigating activity at the city level. Below, we show industrial growth in five of China’s key manufacturing hubs; Shanghai, Guangzhou, Wuhan, Shenyang, and Beijing. Activity in most of these cities is contracting with only Shenyang continuing to experience decent growth.

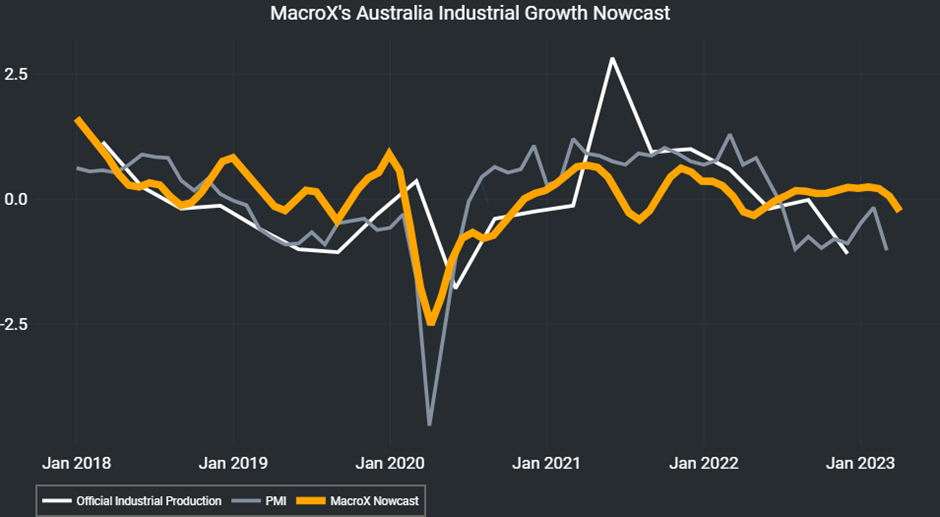

A further way of checking our view on Chinese growth is to look at the performance of other economies which are closely linked to it. Australian economic performance is tied to the Chinese economy due to Chinese demand for Australia’s raw materials and agriculture. Our Nowcast of Australian activity shows no sign of an acceleration post-Chinese reopening, as shown below:

Conclusion

Much like our Nowcast of US activity, MacroX’s alternative data generated nowcast of industrial growth in China is accurate and provides investors with a real-time picture of the Chinese macroeconomy. Having demonstrated its usefulness in measuring activity in an advanced (US) and developing (China) economy, we will next look to see what insights our Nowcasts can provide for countries for which data is often unavailable; the frontier economies.