Key Takeaways

- Tomorrow’s (05/10) CPI print may surprise to the upside

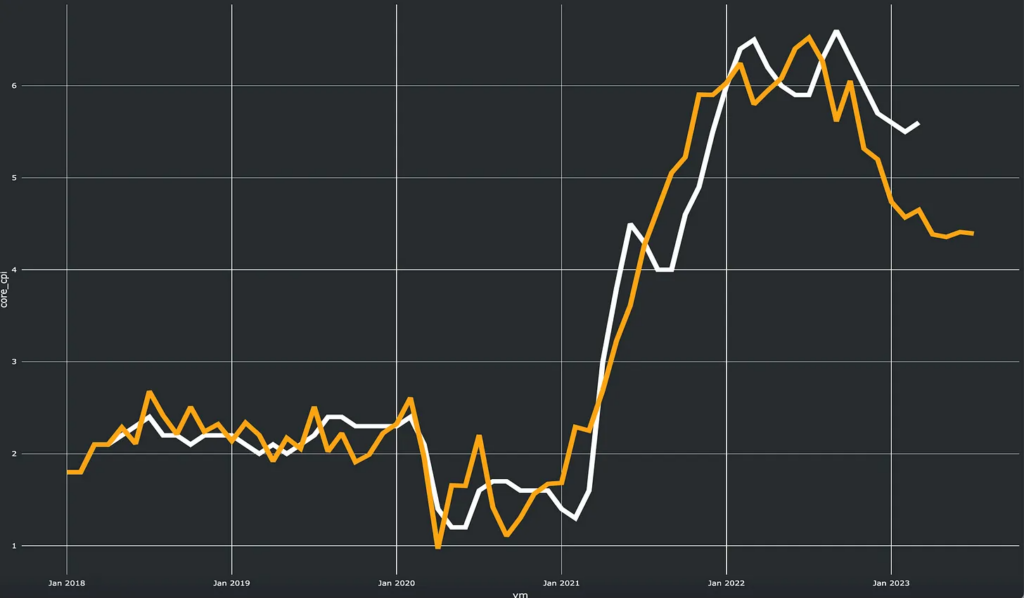

- Using alternative data, MacroX sees US inflation decelerating but remaining over 4% for the next 3-6 months

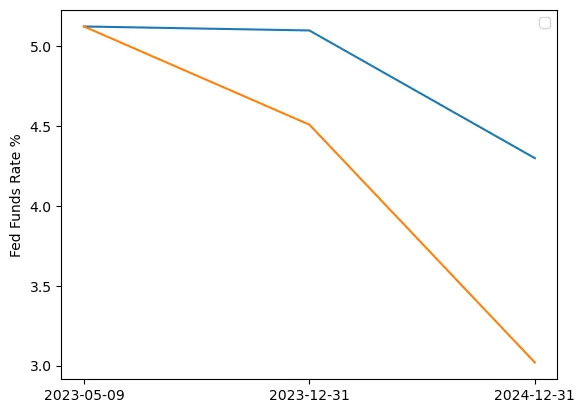

- Given the scale of cuts implied by market pricing, we prefer to be short fixed income

Despite above-target inflation, the market is pricing in cuts

Inflation has been the primary theme driving markets for the last two years. After three decades of inflation being low and stable, inflation started to rear its ugly head in mid-2021 pushing to levels well over the Fed’s 2% target. The Fed has responded to this by raising rates 500bps since the beginning of 2022.

However, market pricing suggests that financial stability concerns and fears over a potential credit crisis have risen in prominence for investors as well as a belief that the Fed will be willing to tolerate above target inflation going forward. Yields have dropped significantly since the failure of SVB in mid-March with 2y rates down around 1% from 5% to 4% despite there being two rate hikes since then! Indeed, over the next 18 months, markets are anticipating that the Fed will begin cutting rates from Q3 this year and for rates to fall almost 200bps as recession fears mount. This is in stark contrast to Fed communications as the latest median dot plots have rates on hold for the rest of the year and 100bps of cuts next year.

Inflation data is a key driver of market pricing

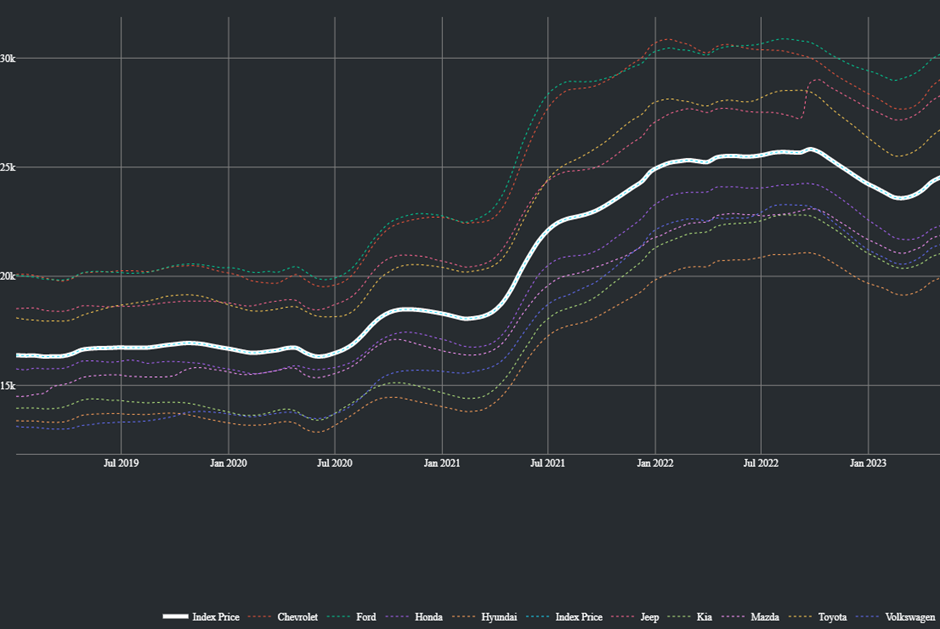

In this post, we focus on the inflation part of the Fed’s reaction function. This week’s CPI data release for consumer prices in April is the first inflation data release since the latest Fed decision to raise rates. Consensus is for a 0.4% rise in the CPI index month-on-month and for the annual CPI rate to remain at 5% whilst the less volatile core measure is forecasted to rise 0.3% mom. However, the recent uptick in the used car market (as shown by MacroX’s used car price monitor) and the stickiness of the CPI’s shelter measure could easily lead to an above-expected print and a sell-off in rates.

Alternative Data generated inflation signals suggests inflation will remain sticky

Like all traditional data sources, US inflation data is lagged by 2+ weeks. Market participants wanting to know what inflation is today in May 2023 will have to wait a month for US CPI and even longer for the Fed’s preferred PCE measure of inflation. Alternative data, on the other hand, is real-time and can be used to generate insights

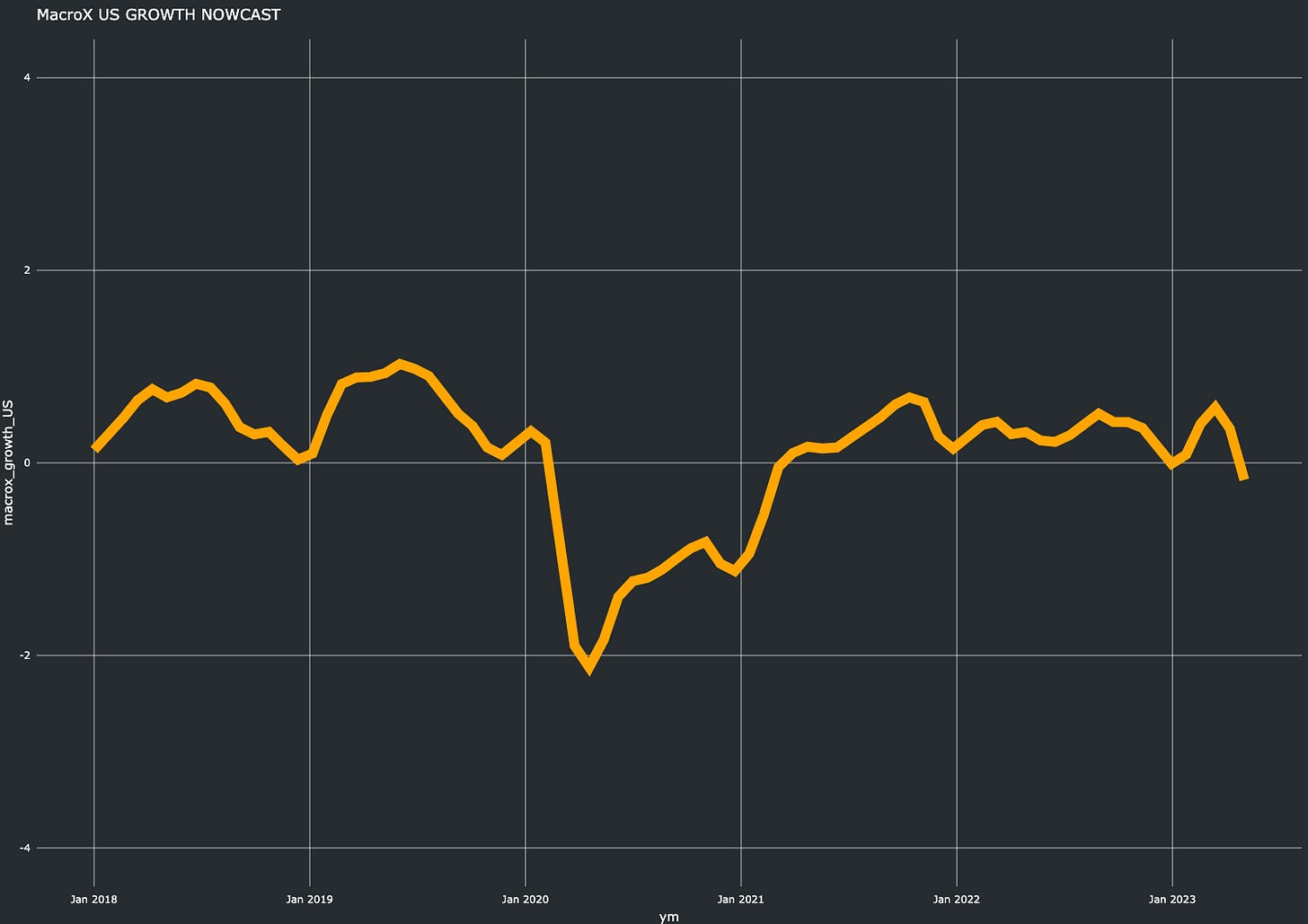

MacroX utilizes alternative data to identify and quantify previously nebulous economic concepts such as labor demand and aggregate demand and uses these as inputs into an economic framework that can not only provide real-time signals but also generates inflation signals for the next 3-6 months.

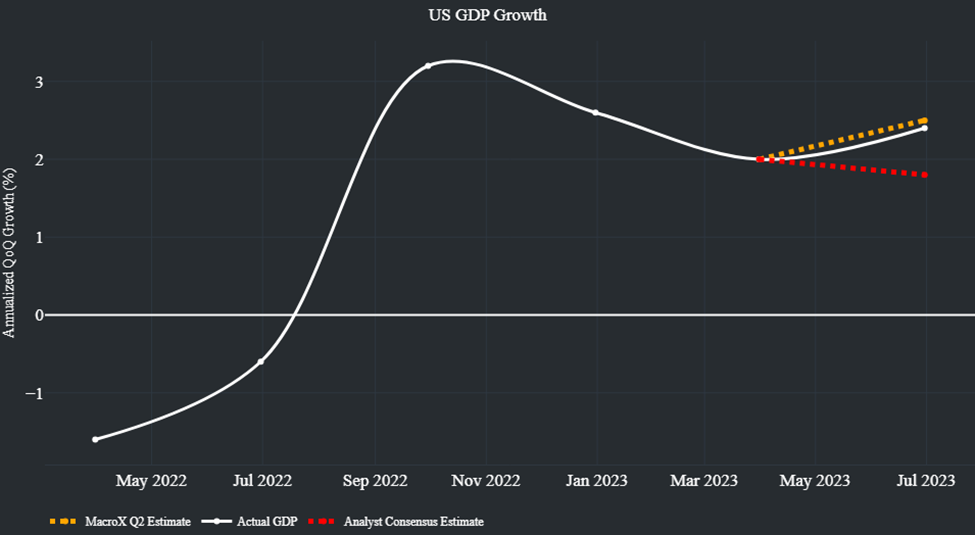

Our measure of inflation suggests that core inflation will continue to fall but also remain sticky at over 4% (well over the Fed’s 2% target) for the next few months, severely restricting the Fed’s ability to cut rates as the market has priced in. Furthermore, our measure of activity in the US economy shows little sign of a credit squeeze-led major downturn in economic growth.

Therefore our real-time measures of activity suggest an economy more in line with the Fed dot plots than market pricing. Given this, our preference is to be paid rates at current levels although the risk remains that a severe tightening of credit conditions is upcoming. Rest assured if this does occur, our insights into the US economy will pick this up first – well before the official data!

Stay Tuned for more alternative-generated insights

The regional banking sector is another key near-term driver for markets over the next few months. Stay tuned to see what our city-level data can tell us about this pivotal sector!