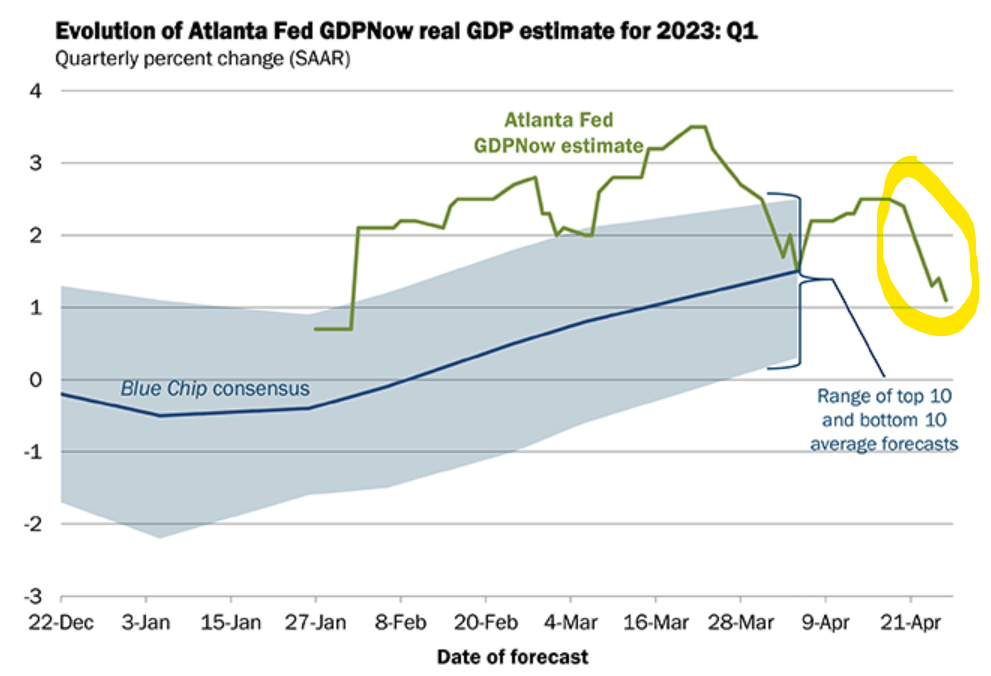

Yesterday’s downward revisions by the US Census Bureau to its retail sales data had a sizeable impact on the Atlanta Fed’s GDPNow Nowcast for Q1 GDP (official data released tomorrow) with it now tracking 1.1% saar (seasonally adjusted annual rate) compared to 2.5% just a week ago! This change brings it in line with our own US Nowcast, as shown in our previous blog post.

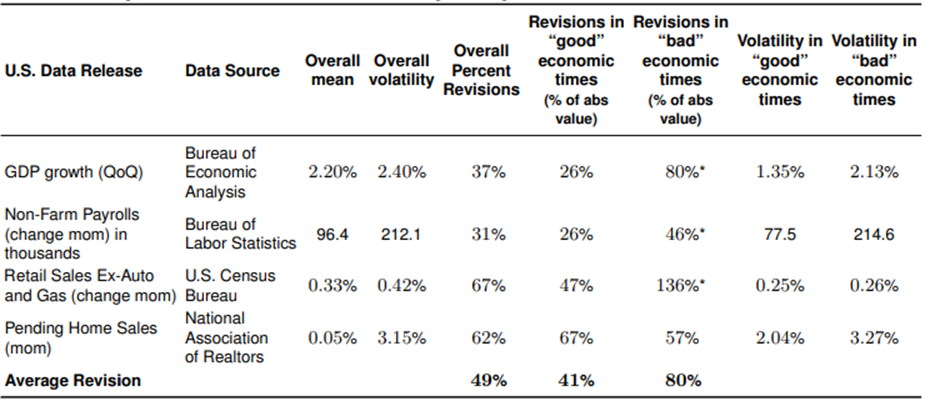

As our founder, Apurv Jain has said in his book chapter on Nowcasting with alternative data, traditional sources of macroeconomic data tend to have substantial revisions. The below table illustrates the scale of the problem:

Data Source: Bloomberg and agencies in table. Data from 1998 onwards

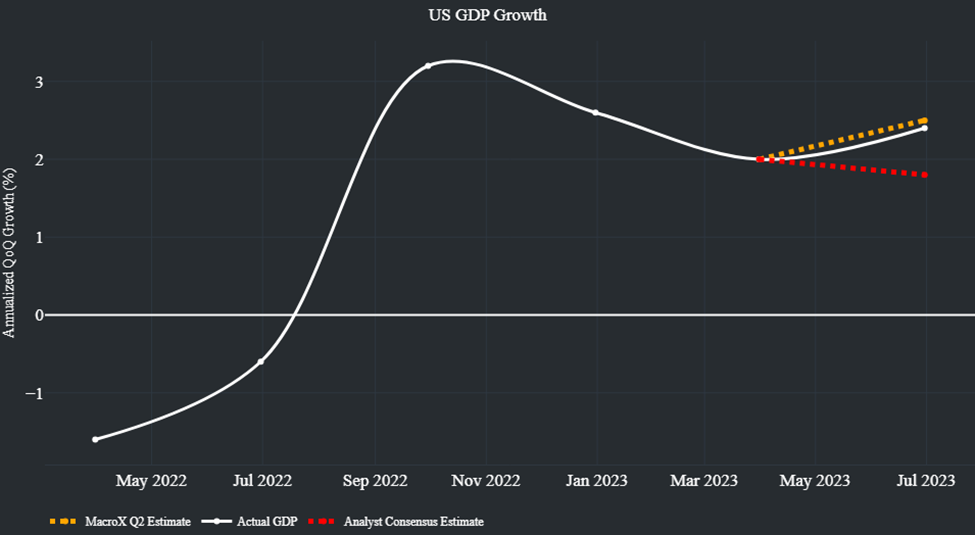

Nowcasts such as the Atlanta Fed GDPNow are reliant on these traditional sources of data and therefore subject to the same revisions. Using alternative data-generated signals provides a way for investors to side-step this problem.