Key Takeaways

- The US Labor market has softened modestly but remains strong and we expect payrolls to be a moderately positive surprise vs. consensus of 180K

- Using alternative data, we see labor demand strong but softening, and labor supply ticking up

- Social data show weaker worker bargaining power, for instance via an increased interest in food stamps as well as lower interest in salaries – which supports the normalizing of Quits

- Temporary job demand – another indicator of lower growth is also increasing – albeit from low levels

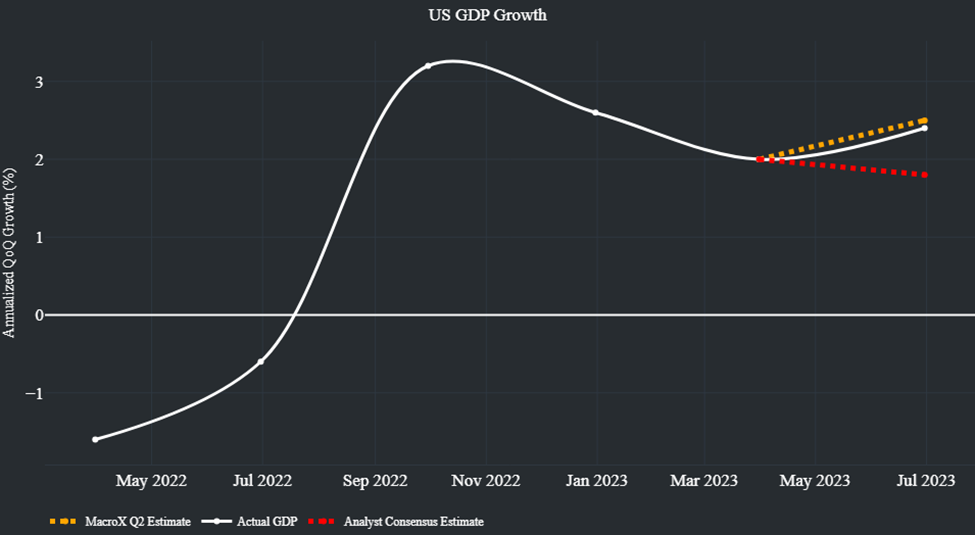

Nonfarm payrolls for October will be released tomorrow. The market is expecting a decrease in jobs added to the US economy to 180k in October from 336k in September. A below consensus number is likely to cause the market to almost completely price out the chance of another hike (currently at c.20%) whilst an above consensus number is unlikely to cause too big a market reaction.

Rather than rely on lagged and noisy government data, at MacroX we synthesize multiple alternative data to deeply understand real-time labor demand and supply separately. Our platform reveals a strong but softening labor market.

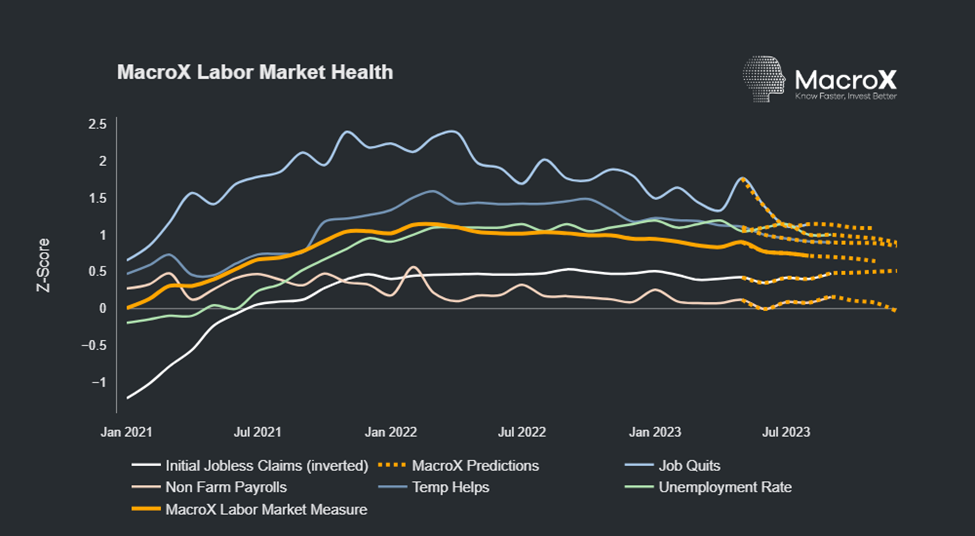

Labor Market Summary: MacroX Nowcasts and Forecasts show a modestly softening labor market

Our model suggests that payroll growth will average 184k over the next three months – in line with consensus. And our nowcasts for key metrics reveal a modestly softening labor market three months ahead. We see a high but softening labor demand, and a modestly increasing labor supply – via a weaker bargaining power for workers which should act as a brake on the wage growth.

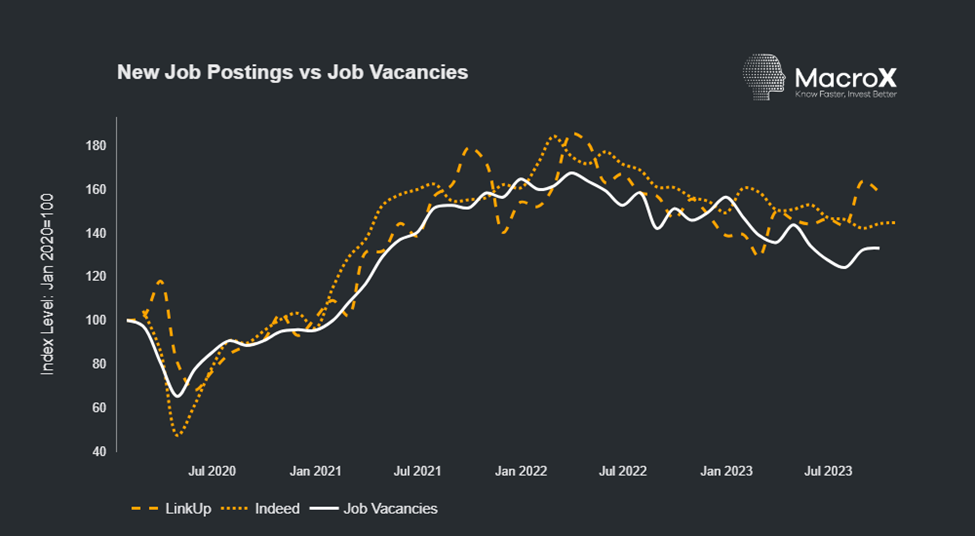

Labor Demand: High but softening

Alternative data measures of postings like Indeed and LinkUp show elevated postings on a downward trajectory. Thus we expect the future JOLTS data to continue to show little acceleration in vacancies – just like the September release.

Labor Supply: Worker confidence is lower

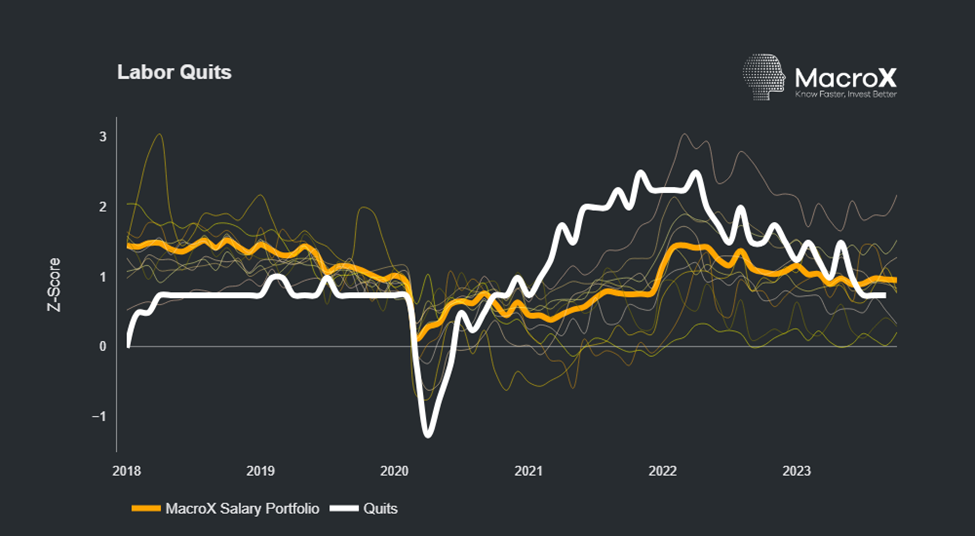

Various alternative data help us measure workers’ bargaining power – via confidence in finding another job as well as their general state. For instance using searches on various salary related terms which predict job quits months ahead, we can see that the confidence is down to a pre-pandemic norm.

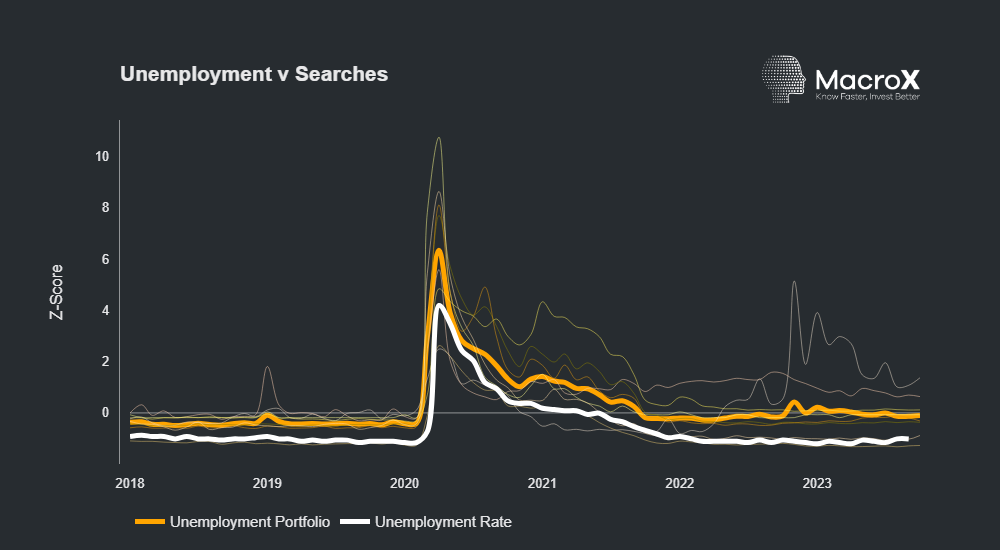

The Unemployment Fear Portfolio is ticking up

Searches and news related to unemployment and insecurity – such as foodstamps and layoffs have increased vs. the pre-pandemic levels, but the overall levels of insecurity are still moderate.

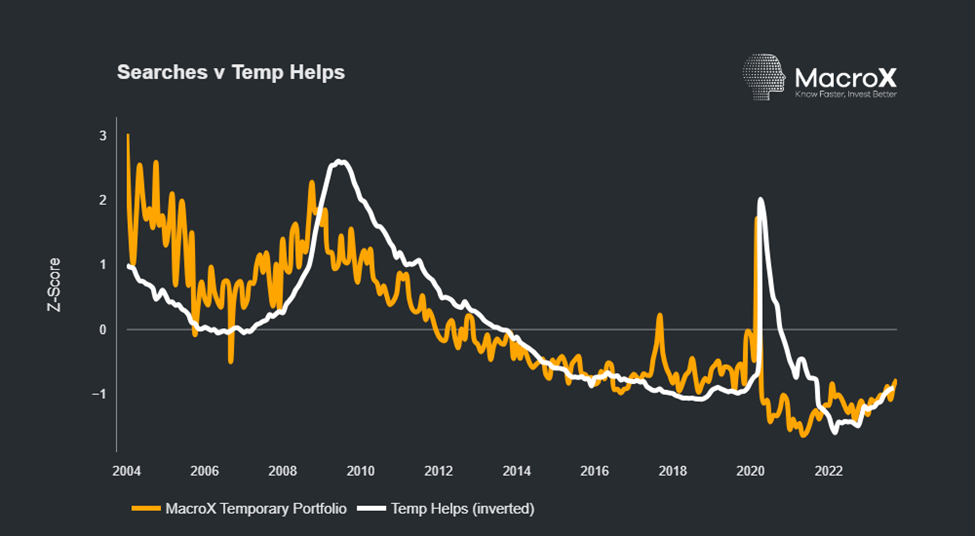

Temporary Helps: Rising but from extremely low levels

Temporary jobs are often the first to be jettisoned in times of economic trouble. Therefore the level of temporary jobs falls dramatically during recessions and can lead other measures of activity. Conversely, during times of economic stress, searches for temporary jobs typically peak. Our portfolio related to the demand for temporary jobs – an indicator of economic trouble – is also rising, albeit from extremely low levels.