Key Takeaways:

- Last week’s lower-than-expected CPI inflation data has caused the market to fully price out any Fed hikes this year in line with our previous post.

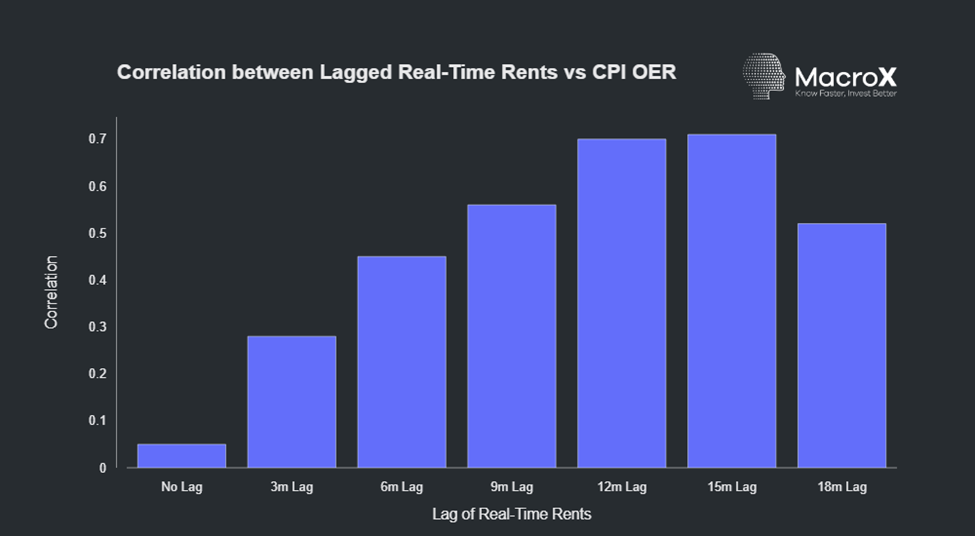

- CPI Shelter’s long-lag (6 -18 months) in responding to real-time rents is responsible for part of the disinflation

- In mapping MacroX’s granular rental measure to CPI, we find a 6-18 month “hump’ shaped effect that supports disinflation for the next 6+ months.

Fed on Hold

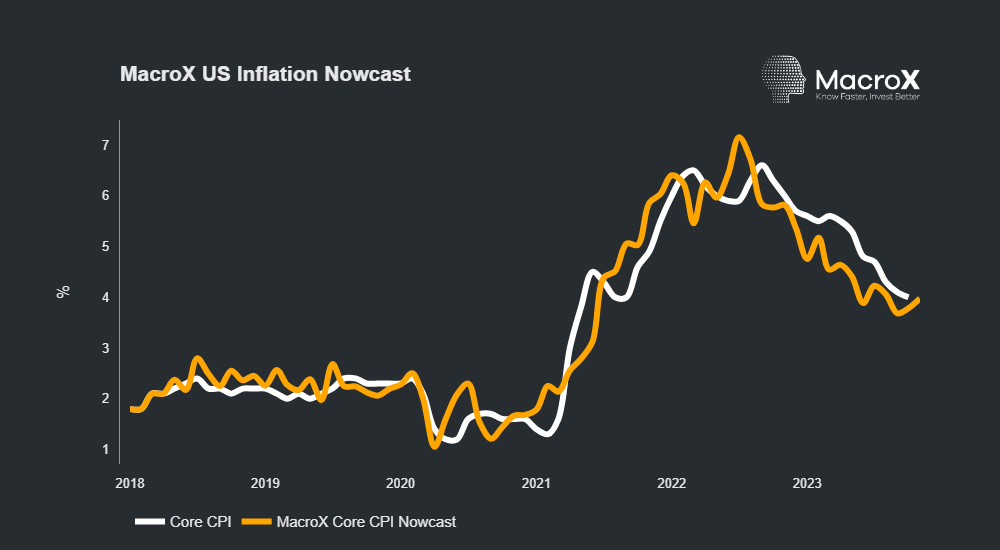

Last week’s CPI inflation data for October will be music to the Fed’s ears. Both headline (0% MoM vs 0.1% expected) and core CPI (0.2% MoM vs 0.3% expected) came in lower than analyst expectations and triggered a rally in fixed income with the market pricing out the chance of a further Fed hike this year, per our expectation that the Fed was on hold for the rest of the year. Our alternative data nowcast of Inflation uses a Phillips curve-inspired framework and has foreseen Core CPI falling to 3.7% by Q4 2023.

The Rental Hump

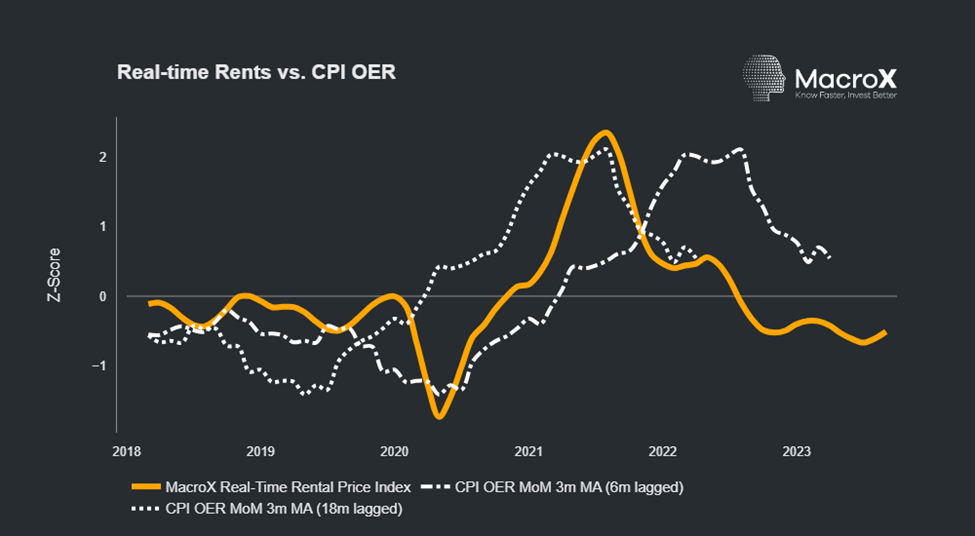

One of the key drivers of the lower-than-expected number was the shelter component which decelerated from 0.6% MoM in Sep to 0.3% MoM in October. The CPI’s shelter component is predominantly made up of measuring Owners’ Equivalent Rent (OER) which is designed to measure home-owners’ cost of housing. As the BLS describes here, it calculates the OER by asking a sample of households this question: “If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?”. As several canny observers have already mentioned, this measure of shelter costs tracks actual rents but is subject to a considerable lag which can easily be seen in the two charts below:

As can be seen in the chart, there is still much of the disinflation in rents still to pass through the BLS’ measure. Therefore, we expect the shelter component of CPI to continue to be disinflationary over the next 6-12 months. Given shelter makes up 40% of core CPI, it should be a powerful restraining force over the headline number as well.